The equity markets are bouncing along support on the lower bound as they wait to hear what Chairman Yellen has to say about the Fed's perspective tomorrow and what else is said over the next few days at Jackson Hole.

As for gold and silver, they went down in honor of the option expiration on the Comex for the most part this week, and today is just the anti-climax.

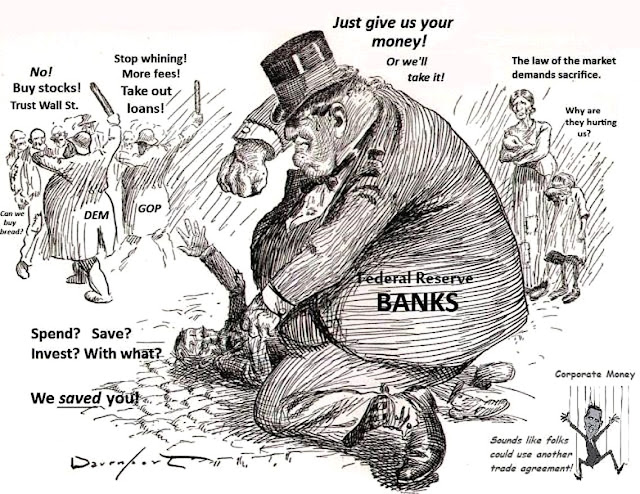

Traders claim to be 'confused' about what the Fed is up to. So for their benefit and yours, here is a brief cheatsheet.

The Fed is very close to the zero bound on their key interest rates. They have been here for a very long time, with most of it proving fruitless at best, and increasing asset price inflation and income inequality for the most part. And that goes double for any of their QE programs which just inflate specific financial assets even more directly.

The 'theory' here is that if you cram enough money into the banks and the wealthy, that some of it will fall through to the lesser beings in the real, as opposed to the financialized, economy. It is not a new idea, not at all.

As J.K. Galbraith put it, “trickle-down theory - the less than elegant metaphor that if one feeds the horse enough oats, some will pass through to the road for the sparrows.”

The Fed would very much like to raise rates off this lower bound. Their reasons have nothing to do with the real economy or inflation. And when they make the case that they want to head off 'wage inflation' in particular I really think someone should just tell them to shut up.

We have had median real wage stagnation in the US for more than twenty years now. To act as though 'wage inflation' would be the most serious problem we might encounter, while the top ten percent have been just rolling in the profits thanks to deregulation and the Fed's absurd monetary catering to the banks, is beneath contempt.

That is just a fig leaf to cover their real objective. The denizens of the Fed, who for the most part are as personally involved in the ups and downs of the real economy as a hydrangea, are inwardly looking and speaking to their own in an echo chamber of policy errors and warped theories, living the cost plus sinecure of professional bureaucrats.

What the Fed wants is to raise rates now, if they can pass the blush test in doing it AND not roil the financial markets of their masters, so that they will have some room in order to cut rates when their latest asset bubble comes apart.

So why are their differences of opinion amongst the Fed heads now? Why in particular does Janet Yellen feel reluctant to raise rates when such luminaries as Stanley Fischer say that recovery is here and its time to go? Besides the theory that Janet is the globalists' designated patsy.

Not everyone passes the blush test as brazenly as others. Indeed, it is hard to think of anything that might make some of our ruling elite, particularly on the political side of things, blush except in the most artificial, histrionic manner. With some very rare exceptions these are not people exactly tormented by ethical considerations and their conscience when it comes to their personal advancement and advantage.

And so here we are.

Have a pleasant evening.